My parents have always taught me to never talk about three things: religion, politics, and money. While not talking about the first two can lead to intolerance and could be why it’s so hard to have discussions about those topics, not talking about money has, or will have, the most tangible effect on my life.

In my experience, my parents have rarely talked to me or my siblings about money. Of course, they’ve talked to me about budgeting, the importance of saving money, and to be careful with what I use my money on, but I barely know anything about 401k’s, how to make a retirement fund, or whether or not I should get a credit card, and this sentiment is shared by other students.

Regarding whether or not he thought he was financially literate, Abram Acunin ‘25 said he overall did not think so.

“I hear a lot about financial stuff and it’s a little overwhelming,” said Abram Acunin ‘25.

“I think I could do stuff with debt, but nothing else,” Noah Sunshine ‘25 said.

In the United States, financial illiteracy cost Americans $436 billion in 2022, with the average adult losing $1,819. Not only that, but 88% of US adults said that high school did not prepare them for the real world. This is a big problem. The American household debt was at $16.9 trillion at the end of 2022. Hundreds of thousands of American adults are in debt. Part of this is from a lack of financial literacy.

It was found by the Federal Reserve Bank of Minnesota that financial education decreased bankruptcies, debt balances, and led to healthier credit card usage. If we are never taught how to be financially literate, then we are more likely to go into debt. Personally, I don’t know how to proactively stay out of debt. I know that I should avoid student loans as much as possible, but that’s about it.

If I didn’t learn about finances in my home, then I would have assumed that I would learn about it in school.

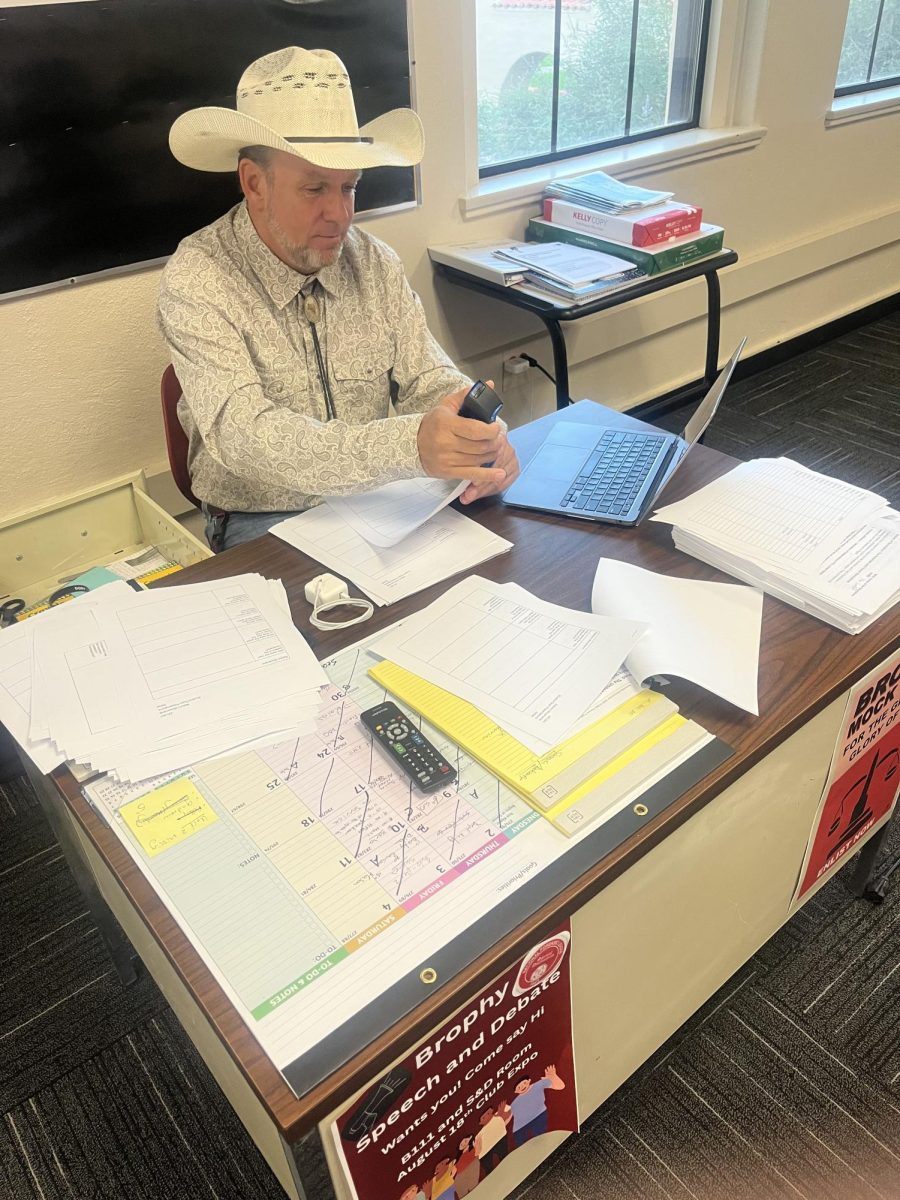

“I think schools should be teaching that because they’re the ones preparing us for life,” Noah Sunshine said. However, as of now, Brophy does not offer any financial literacy classes. There is some legislation in the state of Arizona that would require financial literacy classes, which only goes to show even more that financial illiteracy is a prevalent issue, but because, under Arizona law, private schools can teach what they want without Arizona regulation, it is not a given that Brophy students would benefit from such a class. If we won’t learn about finances at home or at school, then where will we learn about it?

“I’ll find some dude on YouTube who can explain it,” said Aidan Hyde ‘25.

“I probably am going to learn it from my parents eventually,” Abram Acunin said. Learning about finances from home is the most efficient way to learn. Parents can tell their kids about their own mistakes and how they have learned to manage their money in the market.

When asked if he felt prepared for real, fiscal situations, Lucas Vargas ‘26 said he felt “more or less” ready.

“They like to talk about the importance of maintaining good credit with your credit score, paying off credit cards in time to build your reliability as a borrower, and then also about the importance of investing money into trusts and other stock market investments that can increase over time,” said Lucas Vargas.

Ryan Rastad ‘25 felt, for the most part, financially literate and ready for the real world.

“They’ll explain things like budgets, how much they broadly pay for various things, and just how to save money and use money responsibly,” said Ryan Rastad. He said that he learned the majority of his knowledge from his parents.

We need to break the stigma around talking about money in the household. By having parents talk to kids about their mistakes and what they have learned throughout life, we can help the next generation of adults stay out of debt and be prepared for the real world.