Brophy needs to mandate a financial literacy class as a graduation requirement. Whether that be a part of the Innovation and Arts Department or as an elective, education on personal finance should be regarded as a necessary requirement because it fosters future success.

Financial literacy classes teach how to properly spend money and make sound financial decisions. With a requirement, Brophy can better advise its students to make healthy and mature choices with their money.

According to a California Department of Education study, students who have undergone a form of financial education have been found to accrue less debt and lead a higher quality of life.

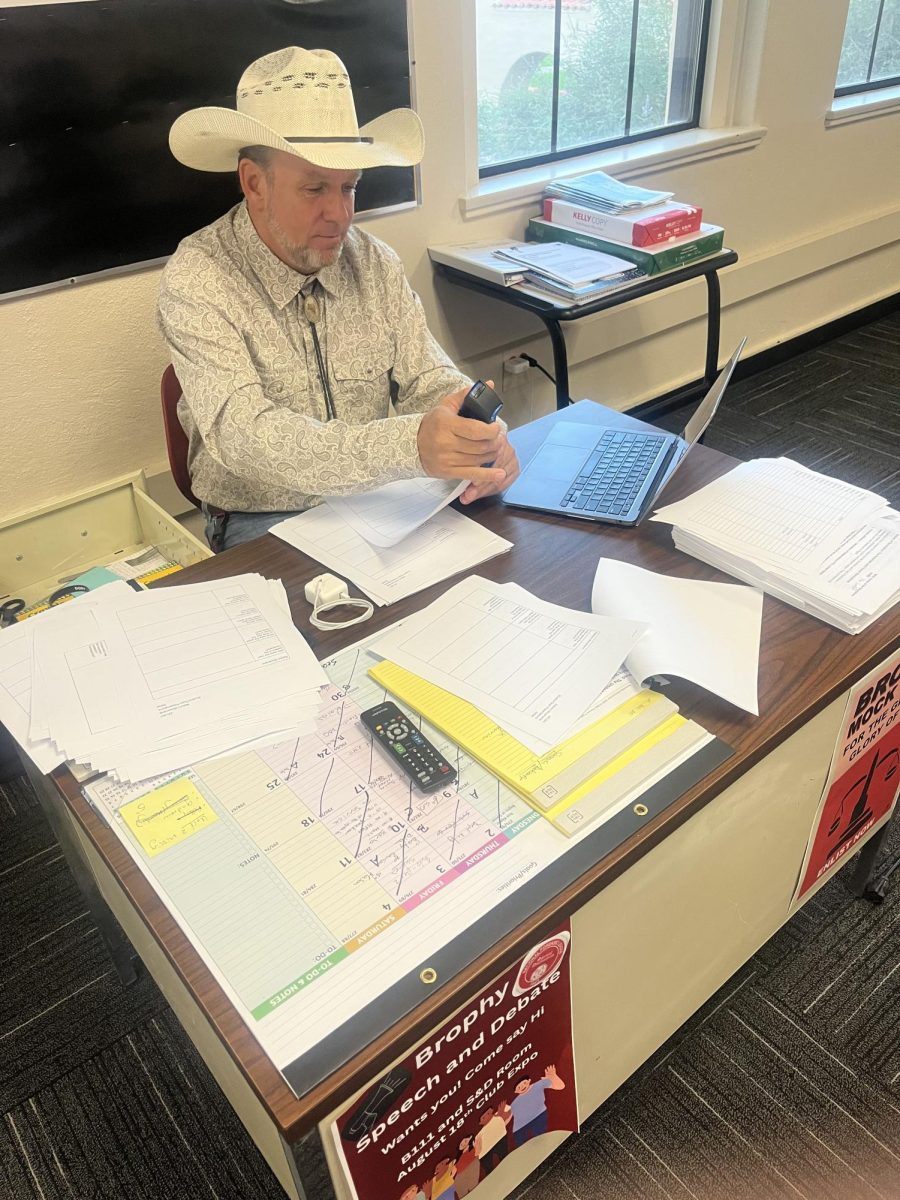

While studies highlight the broad benefits of financial education, personal experiences at Brophy reveal gaps in current offerings. As of now, as a senior at Brophy, I have been exposed to very little personal finance education, aside from last year’s summit on debt and dignity. However, Connor McDonnell ’25, on the contrary, has had more education on personal finance. McDonnell took Consumer and Business Finance, taught by Mr. Cook, in his junior year.

While financial education is taught at Brophy, McDonnell argued that while the class offered good financial instruction, it lacked at teaching him more about the intricacies of building wealth. For example, when asked if the class taught about how to properly invest or utilize a Roth IRA (Individual Retirement Account), common methods of accruing wealth, McDonnell stated his class did not go in depth into those topics.

Nevertheless, after analysis of his financial education, “A financial class would be a good requirement,” said McDonnell. However, he contended that the class would have to be different than the one he took; it would need to be more in-depth and specific on personal financial decisions.

A requirement, such as this, can be easily justified as Ramsey Solutions, a company focused on promoting people to take control of their money, found that “3 in 4 U.S. adults said in the years after high school, they “often” or “sometimes”felt stress because of money.”

Moreover, this requirement will be met with open-arms by the student body as Fox Business reported “[An] Intuit’s Financial Education survey found that 85% of U.S. high school students said they’re interested in learning about financial topics at school.”

Implementing a financial literacy requirement will not only align with Brophy’s mission of holistic education, but also empower students to make informed financial decisions, ensuring their success beyond high school.