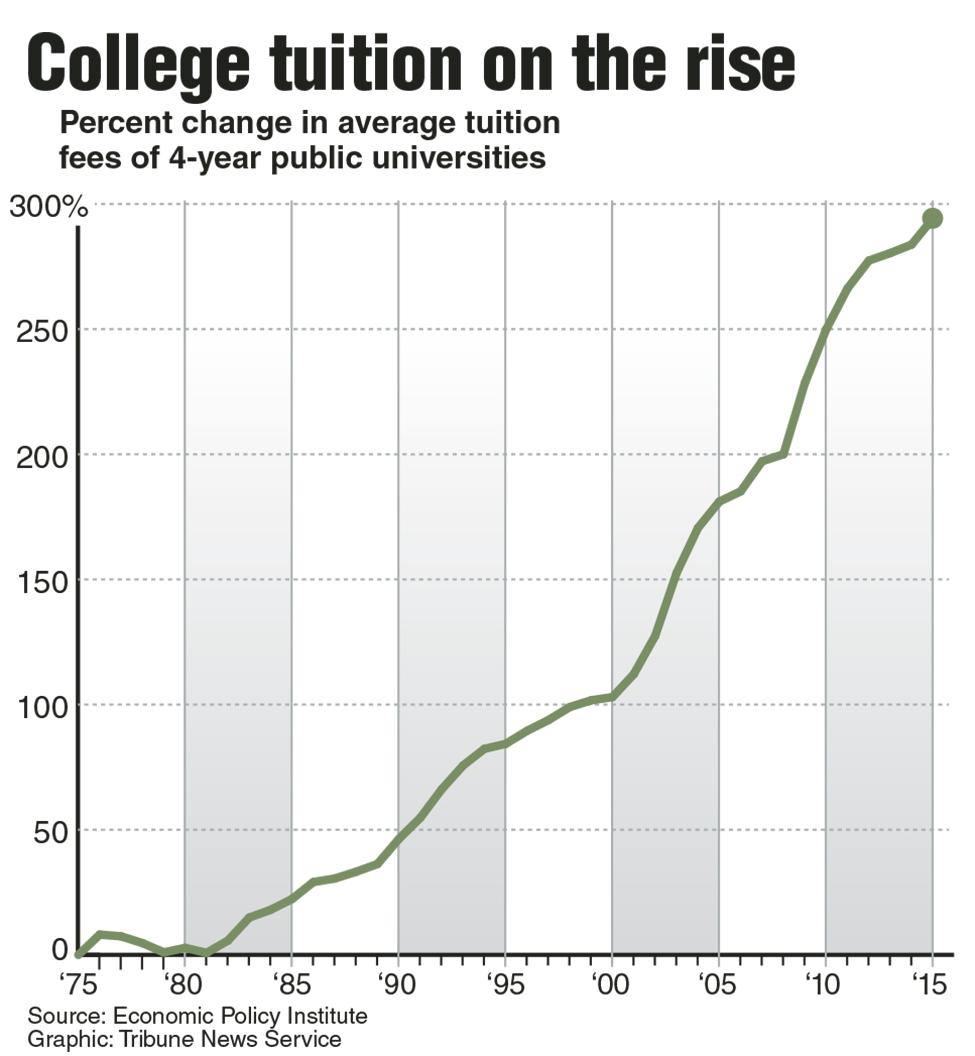

Chart showing the percent change in average tuition fees of 4-year public universities history of College tuition pricing from 1975-2015. TNS 2016

By Jack Cahill ‘17

THE ROUNDUP

In the last several decades, the average college tuition bill has skyrocketed, hindering many intelligent young men and women from attaining a decent college education.

While there have been a plethora of proposals to fix this, and some proposals to leave it as is, there is not a single solution to the question of rising tuition rates nationwide.

First, we need to understand the costs of a higher education in this nation.

Forbes Magazine calculated the projected average cost of colleges for the 2015-2016 school year. A public college costs an average of $28,000 a year, a private college costs an average of $59,000 a year, and an elite college an average of $70,000 a year.

By 2025, these rates are expected to double.

That should be alarming for any young American seeking a quality higher education.

Candidates from both political aisles have proposed solutions to the issue, but those proposals are often hit or miss.

One solution often proposed is to divert more federal money to higher education.

Unfortunately, this approach is a failure before it starts.

Former Secretary of Education William Bennett recognizes this.

“If anything, increases in financial aid in recent years have enabled colleges and universities blithely to raise their tuitions,” Bennett said in The Washington Post. “They’re so confident that federal loan subsidies can cushion these increases.”

Many intellectuals today use the term “Bennett Hypothesis” to refer to the fact that federal aid is higher than ever, but so is college tuition. The correlation simply cannot be denied.

In fact, a 2014 University of Maryland study conducted by Professor Lesley J Turner found that Pell Grants and financial aid can actually act as a net detriment.

A Pell Grant is a government issued subsidy given to lower income students who cannot afford a full four year education.

According to Turner, increases in federal aid often lead to two things.

The first is that universities often abuse federal aid that would be given to subsidize lower income students. Instead of spending this money on student aid and grants, it is often spent elsewhere.

For example, the Department of Education found that $3 billion of unclaimed grant money was essentially wasted, often spent on new amenities for colleges, or not spent at all.

Secondly, Pell Grants, which lead to an increase in tuition for those who are not eligible for these grants, are a failure even when they’re handed out properly.

Sam Kissinger of Ohio University, talking to Forbes, observed a direct correlation between increased federal aid and spikes in tuition, but he also observed that nearly half of the Pell Grant students don’t graduate university.

Why bother using taxpayer money on costly government subsidies when they both result in increased tuition rates for the rest of the country, and a program where half of students don’t graduate?

That’s ludicrous.

If the status quo idea of more federal aid is a failure, then what is the solution?

I propose modest cuts in Pell Grants to alleviate the burden middle class families who find it increasingly difficult to send their children to college.

Furthermore, there is a need to ensure that only families who need federal grants receive them, to avoid artificial tuition hikes.

According to Forbes and Kissinger, this will allow those with real merit to be given these grants, thus taking a large financial burden off those who are not eligible for these grants, but also find it hard to afford college.

Most importantly, universities need to be held accountable for aid and grants, and they need to be accountable for loan delinquencies that undermine affordable college tuition.

College will never be free. But with these common sense solutions, it can be more affordable for generations to come.